Hard Inquiries vs. Soft Inquiries and How They Impact your Credit Score

Key Takeaways

- You must give businesses authorization to review your credit, creating a hard inquiry.

- Companies use credit reviews to identify consumers who may be interested in their services, creating a soft inquiry.

- Soft inquiries will not impact your credit score, and companies do not need authorization to view your credit profile.

You don’t want to do anything that could lower your credit score because you are afraid you might need a good score to qualify for a loan or service at some point in the future. The challenge is that the credit scoring process includes things you might not consider.

Take loan applications or unsolicited credit offers. Both these situations mean a company gained access to your credit report, and those inquiries could hurt your score without you realizing it.

What is a Hard Inquiry?

A hard inquiry or hard pull is when a company reviews your credit as part of the application process. Lenders, credit card issuers, banks, insurance companies, and utilities typically require a credit review when applying for an account or the company’s services.

How Does a Hard Inquiry Affect Your Credit Score?

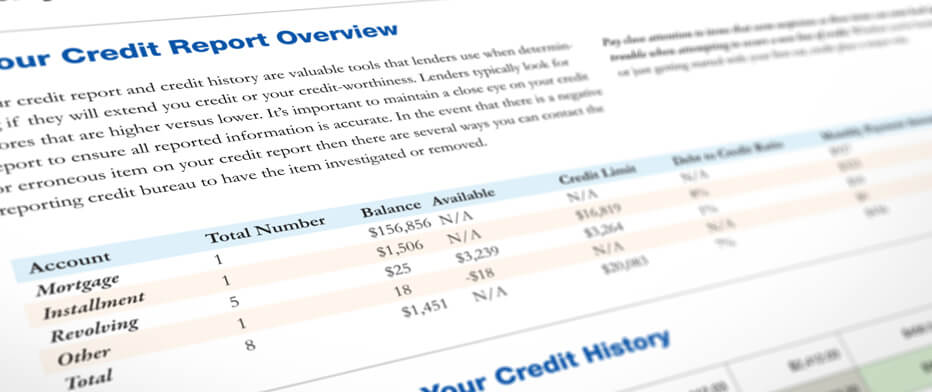

Credit scoring companies use five primary factors to calculate your credit score. These include:

- Payment history (35%)

- The amount owed versus lines of credit (30%)

- Credit mix or loans versus lines of credit (10%)

- Length of your credit history (15%)

- New credit based on credit inquiries (10%)

While new applications are one of the lowest-rated activities in your credit, having too many inquiries can lower your score by several points. This is especially true if you complete multiple applications within a short period.

The algorithms do not penalize you for shopping rates on a large purchase. FICO does not consider any inquiries within a 30-day window for home, auto, and student loans. When you apply within a 45-day window, FICO considers all applications as one inquiry.

Consolidated inquiries only apply to applications for the same loan type. For example, if you apply for both a credit card and a home mortgage in the same week, it would be two inquiries. However, you could apply for a mortgage with six different lenders within 45 days, and FICO would only tabulate a single query.

FICO considers applications for personal loans and credit cards as one inquiry for each application.

Vantage score treats all inquiries for the same loan type within a 14-day window as a single inquiry.

Lenders associate credit inquiries with increased risk. According to FICO, “people with six or more inquiries on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.”

How Long Will a Hard Inquiry Remain on Your Credit?

Credit requests remain on your credit report for two years. However, the inquiries do not affect your score after one year.

What is a Soft Inquiry?

A soft inquiry or soft pull occurs mostly for marketing purposes. Companies review credit profiles to identify consumers, it might target in a marketing campaign or as an account review for existing customers. Some of the common reasons you have soft pulls on your credit report include the following:

- Consumer inquiries – you request to see your credit file

- Promotional – requests made by creditors for promotional or pre-approved credit offers.

- Account reviews – current creditors, utilities, or insurance companies periodically review your credit file. Improved credit could lead to additional offers, where a decline in credit could result in credit line reductions, higher rates, or closed accounts.

- Employer requests – Some positions allow employers to review credit when applying to a job or seeking a promotion.

- Housing requests – Landlords often review credit as part of the application approval process.

How Does a Soft Inquiry Affect Your Score?

Credit bureaus list a two-year history of soft inquiries, but they do not affect your credit score.

FAQ

REPRESENTATIVE EXAMPLE OF APR

If you borrow $30,000 over a term of 5 years (60 months) with an APR of 4.99% you will pay $566.00 each month. The total amount payable will be $33,959.97, with total interest of $3,959.97.

ANNUAL PERCENTAGE RATE (APR)

Annual Percentage Rate (APR) represents the annualized interest rate you are charged for borrowing. It is the combination of the nominal interest rate and some additional costs such as fees involved when incurring debt. Our lender offers APRs for personal loans, cash advance loans, installment loans and debt consolidation loans from 4.99% to 35.99%. Since New Start Capital does not directly issue loans, we cannot deliver any specifics or guarantee the APR you will be offered. The APR depends solely on your lender’s decision, based on various factors including your credit score, credit history, income, and some other information you supply in your request. For more information regarding the APR contact your lender.